Fire Zones and Insurance: What Land Investors Need to Know in Central California

Wildfire risk isn’t just a buzzword in the Central California foothills — it’s one of the biggest factors shaping insurance costs, land values, and long-term development feasibility. Whether you’re looking at Oakhurst, Coarsegold, Ahwahnee, North Fork, or anywhere along the Highway 41/49 corridors, fire zones determine far more than most buyers realize.

If you’re planning to invest in land — especially raw or lightly improved acreage — this is one topic you cannot skip.

Below is the complete guide to understanding fire risk, insurance, compliance requirements, and how all of this impacts your investment.

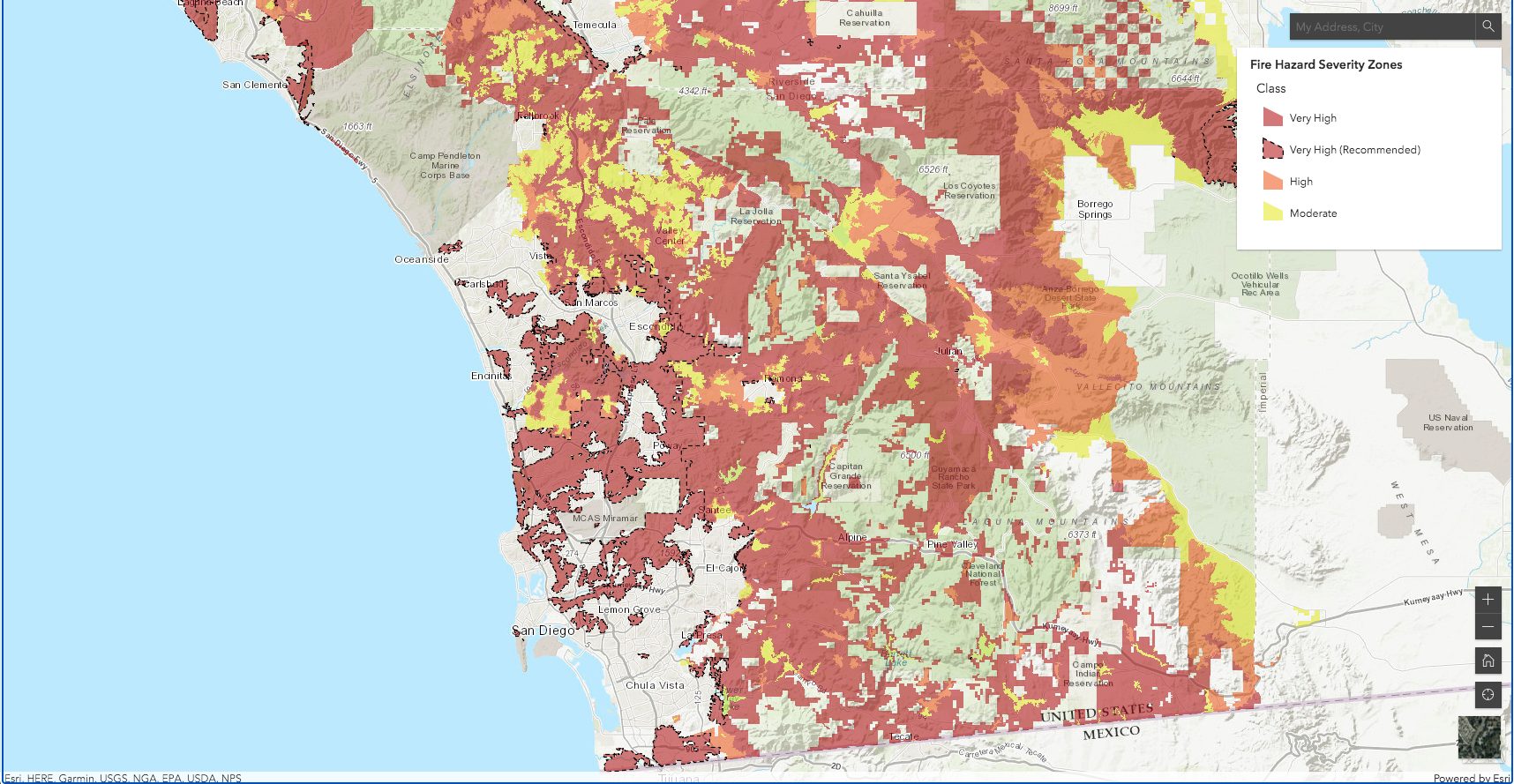

1. What Are Fire Hazard Severity Zones?

California designates three main wildfire risk tiers for State Responsibility Areas (SRA):

-

Moderate

-

High

-

Very High Fire Hazard Severity Zone (VHFHSZ)

Most of the Central California foothills fall into High or Very High, especially:

-

Oakhurst (93644)

-

Coarsegold (93614)

-

North Fork (93643)

-

Mariposa County borders

-

Bass Lake region

How to check the fire hazard severity for a parcel

CAL FIRE provides the official mapping tool:

🔗 CAL FIRE Fire Hazard Severity Zone Map

https://egis.fire.ca.gov/FHSZ/

You can look up an APN or zoom in manually.

2. Insurance Is Getting Harder — Here’s Why It Matters

Wildfire risk affects:

✔ Insurance availability

✔ Insurance cost

✔ Lender requirements

✔ Future resale value

✔ Buildability

✔ Feasibility of short-term rentals or long-term rentals

In many high-risk zones, buyers are getting:

-

Quotes 3–8× higher than they expected

-

“Surplus line” (non-admitted) carriers

-

FAIR Plan + wraparound policies

What is the FAIR Plan?

When no carrier will issue a standard policy, California’s FAIR Plan provides basic fire coverage.

🔗 California FAIR Plan

https://www.cfpnet.com/

Most homeowners then add a “difference in conditions” (DIC) policy for liability, theft, water damage, etc.

3. How Insurance Impacts Land Purchases

If you’re buying raw land, the insurance conversation really matters when:

-

You plan to build

-

You plan to rent the future home

-

You need construction insurance

-

You need coverage during grading or infrastructure work

Key point:

Some lenders won’t fund construction loans in VHFHSZ zones unless insurance is secured first.

This can make or break a deal.

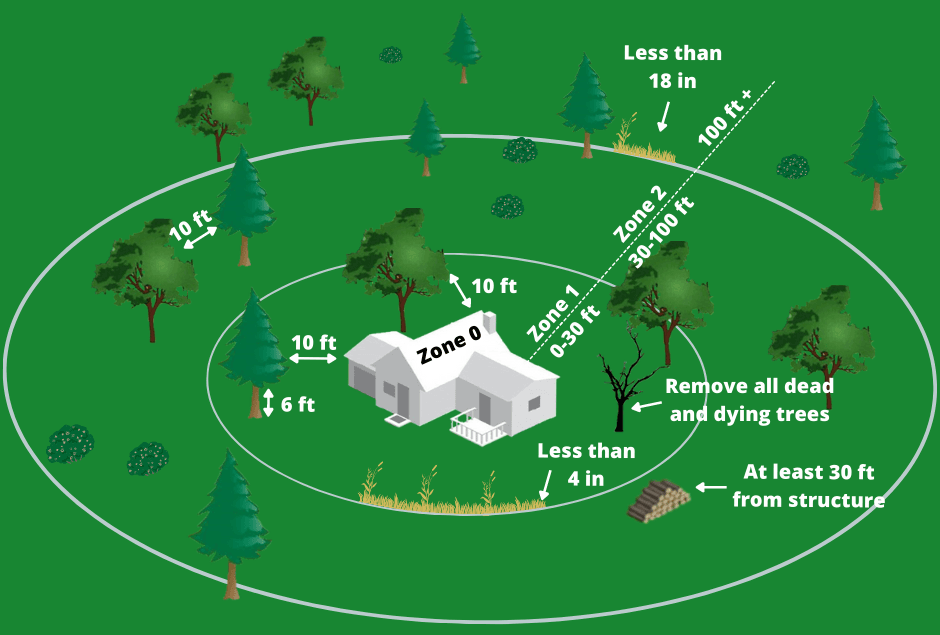

4. Defensible Space Laws You Must Know (100-Foot Rule)

California requires 100 feet of defensible space around all structures — and this affects not just homes, but also:

-

ADUs

-

Cabins

-

Sheds

-

Short-term rentals

These requirements are enforced by CAL FIRE:

🔗 CAL FIRE Defensible Space Requirements

https://www.fire.ca.gov/programs/communications/defensible-space-prc-4291/

You must clear:

-

Flammable brush

-

Dead trees

-

Ladder fuels

-

Excess vegetation

For buyers, this means two things:

-

Your future building site must have enough room to create defensible space.

-

If the lot is heavily forested, clearing may cost $5,000–$40,000+ depending on density and slope.

5. Fire Hardening Requirements for New Builds

Homes built in the foothills must meet the Wildland Urban Interface (WUI) building codes, including:

-

Class A fire-rated roof

-

Non-combustible siding materials

-

Tempered glazing

-

Ember-resistant attic vents

Ember-resistant attic vents -

Defensible space planning

Official resource:

🔗 California Building Code – Wildland Urban Interface (WUI) Requirements

https://osfm.fire.ca.gov/divisions/wildfire-planning-engineering/building-codes/

These regulations increase construction cost, but they also increase long-term safety and insurance eligibility.

6. Understanding Fire Behavior in the Foothills

Fire moves differently in the Sierra foothills due to:

-

Steep slopes

-

Dense vegetation

-

Afternoon up-canyon winds

-

Fuel buildup

-

Rural access limitations

Buyers should evaluate:

-

How steep the parcel is

-

Whether the driveway is long/narrow

-

Whether fire trucks can access the property

-

If there is a cleared building pad

-

Whether neighboring lots are maintained

Many buyers overlook the neighbor’s defensible space compliance, which affects your insurance eligibility.

7. How Fire Zones Affect Land Value

1. High-risk areas appreciate slower

Land in VHFHSZ areas may:

-

Sit longer on market

-

Appreciate slower

-

Cost more to develop

But it may also sell much cheaper upfront, which attracts investors.

2. Existing improvements raise value

Parcels with:

-

Cleared pads

-

Driveways

-

Water

-

Power

-

Septic

-

Established defensible space

…are worth significantly more and easier to insure.

3. Some buyers avoid high-risk zones entirely

Meaning reduced buyer pool, but also less competition for savvy investors.

8. How to Protect Yourself as a Land Buyer

Here’s your fire-risk due diligence checklist:

✔ 1. Check CAL FIRE hazard severity maps

See whether the parcel is Moderate, High, or Very High.

✔ 2. Get insurance quotes early

Don’t wait until escrow is almost closed.

✔ 3. Ask about defensible space violations

Sellers must disclose vegetation hazards.

✔ 4. Inspect tree density and slope

Steep parcels cost more to clear.

✔ 5. Evaluate access for emergency vehicles

Driveway width matters.

✔ 6. Research nearby fire history

Use Cal Fire’s incident map:

🔗 CAL FIRE Incident Map

https://www.fire.ca.gov/incidents/

✔ 7. Confirm hydrant distance (if applicable)

Some areas require water storage tanks if hydrants aren’t nearby.

✔ 8. Analyze insurance + clearing costs in your ROI

Especially for investment or development projects.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Ember-resistant attic vents

Ember-resistant attic vents